will child tax credit monthly payments continue in 2022

Thats because only half the money came via the monthly installments. Here is what you need to know about the future of the child tax credit in 2022.

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

The future of the monthly child tax credit is not certain in 2022.

. The payments were monthly. Now even before those monthly child tax credit advances run out the final two payments come on Nov. The short answer is NO since a funding extension for 2022 payments has not yet been approved by Congress.

The Child Tax Credit for 2021 introduced a new feature. There May Still Be Hope for Monthly Child Tax Credit Payments in 2022. Remains opposed to both the size of the bill and the idea of extending the monthly child tax payments.

The future of the monthly child tax credit is not certain in 2022. Heres what to expect from the IRS in 2022. Losing it could be dire for millions of children living at or below the poverty line.

However for 2022 the credit has reverted back to 2000 per child with no monthly payments. Treasury distributed payments beginning in July 2021. Taxpayers could receive direct advance payments of their Child Tax Credits in amounts of 250 or 300 per qualifying child depending on their age.

Child Tax Credit Payments Still Arent Getting to Those Who Need Them Most. Government disbursed more than 15 billion of monthly child tax credit payments in July to American families. Therefore child tax credit payments will NOT continue in 2022.

Simple or complex always free. So parents could only receive half their total child tax credit money 1800 or 1500 via those payments -- 300 per child per month under age 6 and 250 per child per month for ages 6-17. Since Congress did not extend the higher child tax credit amounts CTCs revert back to 2000 per child.

The way it looks right now the increased child tax credits wont be continuing into 2022. But this may not preclude these payments. Those who opted out of all the monthly payments can expect a 3000 or 3600.

Theres a plan to extend the credit but politics is getting in the way. Heres what to expect from the IRS in 2022. Heres Why by Angelica Leicht Published on May 19 2022.

As it stands right now child tax credit payments wont be renewed this year. During the second half of 2022 parents enjoyed monthly Child Tax Credit payments. July 5 2022 653 AM.

The law authorizing last years monthly payments clearly states that no payments can be made after December 31 2021. File a federal return to claim your child tax credit. Those who opted out of all the monthly payments can expect a 3000 or 3600.

The benefit for the 2021 year is 3000 and 3600 for children under the age of 6. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. Zebulon Newton received the last monthly Child Tax Credit payment of 550 for his two children on December 15th.

15 Democratic leaders in Congress are working to extend the benefit into 2022. However Congress had to vote to extend the payments past 2021. But is ending payments a wise decision as the economy continues to struggle.

Thats because only half the money came via the monthly installments. Now even before those monthly child tax credit advances run out the final two payments come on Nov. Child tax credit payments in 2022 will revert to the original amount prior to the pandemic.

Washington lawmakers may still revisit expanding the child tax credit. The benefit for the 2021 year is 3000 and 3600 for children under the age of 6. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

The irs has now processed the sixth december and final round of advance 2021 monthly payments for the expanded child tax credit ctc to parents and guardians with eligible dependents. Ad Discover trends and view interactive analysis of child care and early education in the US. The 2022 child tax credit is set to revert to 2000 for each dependent age 17 or younger.

Losing it could be dire for millions of children living at or below the poverty line. The last round of monthly Child Tax Credit payments will arrive in bank accounts on Dec. 15 Democratic leaders in Congress are working to extend the benefit into 2022.

Get the up-to-date data and facts from USAFacts a nonpartisan source. Five months after the credits expired its getting harder. Advanced monthly payments totaled 300 per child under the age of 6 and 250 per child ages 6 to 17.

Those payments are off the table for now but the credit isnt gone. No monthly CTC. Within those returns are families who qualified for child tax credits CTC worth up to 3600 per child but you can still receive up to 2000 per child for 2022.

I have written detailed articles covering FAQs for this payment but the main one being asked now is whether or not families will continue to get paid monthly in 2022 starting with the first payment on January 15 2022. Congress fails to renew the advance Child Tax Credit payments which would have been part of the Build Back Better Act and the payments expire. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Advanced monthly payments totaled 300 per child under the age of 6 and 250 per child ages 6 to 17. Child tax credit payment schedule for the rest of 2021 the irs has already sent two batches of monthly child tax credit payments. Families who qualify for the enhanced Child Tax Credit benefits may see their final advanced payments as the program is scheduled to end Dec15 unless Congress extends it.

Federal Stimulus Update Will Child Tax Credit Monthly Payments Restart

/cdn.vox-cdn.com/uploads/chorus_asset/file/23423371/GettyImages_1328589075.jpg)

Will There Be An Expanded Child Tax Credit In 2022 Vox

Will Child Tax Credit Payments Be Extended In 2022 Money

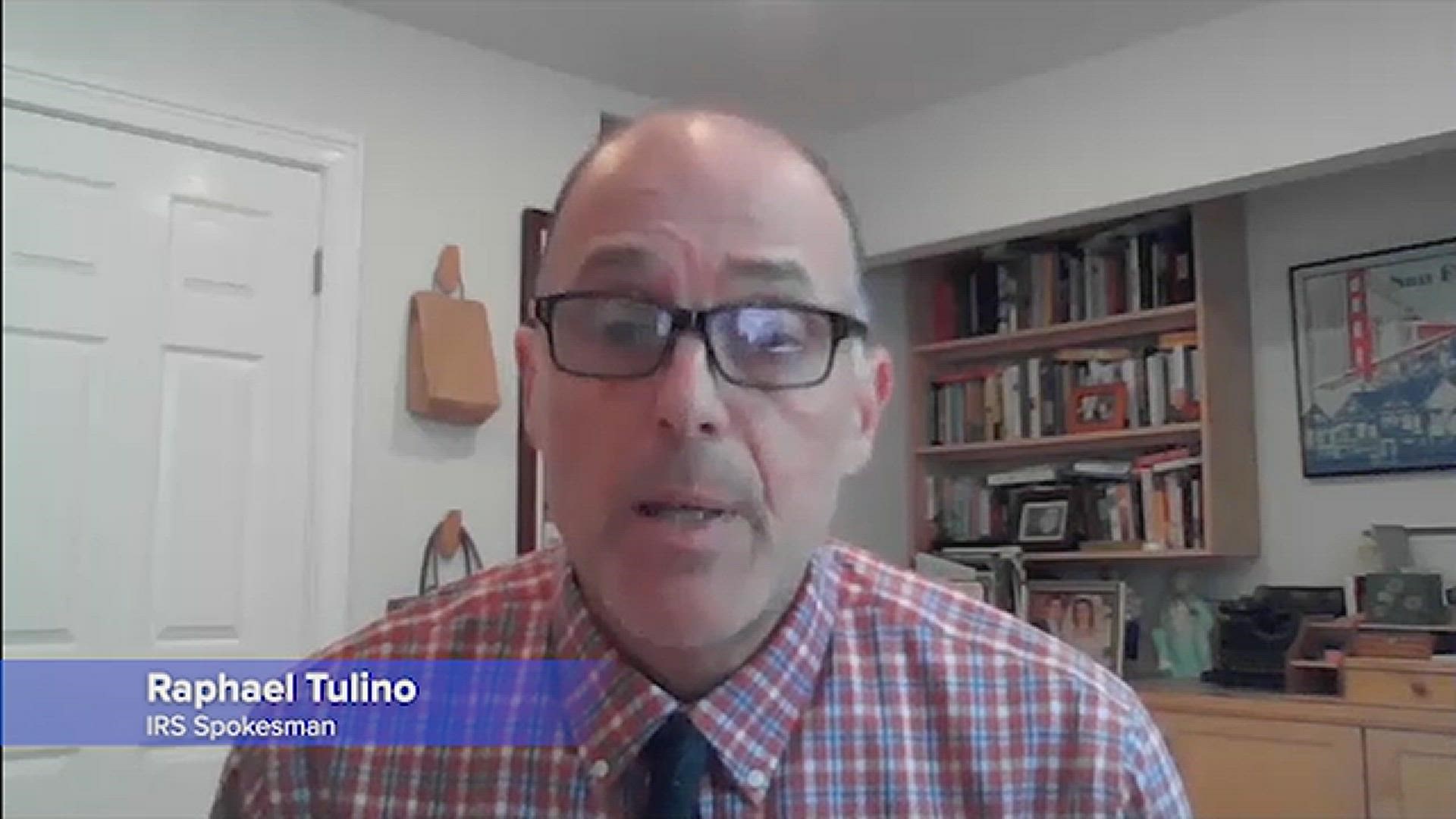

Child Tax Credit Will Monthly Payments Continue In 2022 Abc10 Com

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

Child Tax Credit You Could Get A Double Payment In February Here S Why

Stimulus Update Could 300 Monthly Federal Child Tax Credit Be Made Permanent Cleveland Com

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

New Child Tax Credit Payments Arrive This Week Is This The Final Stimulus Check

Eliminate Common Tax Issues Wage Garnishment Tax Irs

Families Face First Month Without Child Tax Credit Payments Since July Cronkite News Arizona Pbs

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It

Where Should I Invest Bonus Of Rs 50 Lakh Should I Invest Lump Sum Or Through Sips In 2022 Investing Investing In Stocks Investment Services

Child Tax Credit Will Monthly Payments Continue In 2022 Abc10 Com

Will Monthly Child Tax Credit Payments Be Renewed In 2022 Kiplinger

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Child Tax Credit 2022 Will Ctc Payments Finally Be Extended Marca